“Naked Insurance secures R700m [$38m] to enhance AI-driven solutions and expand its digital-only offerings,” says Alex Thomson. – Moneyweb on X

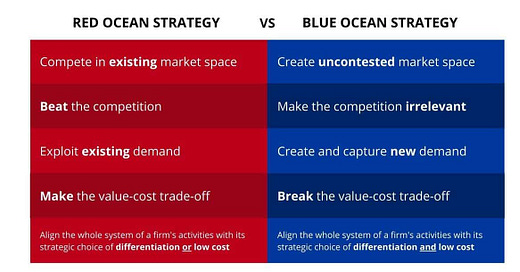

That’s great news, and I sincerely wish them nothing but success as they grow their business. However, I see three key challenges that keep them hooked in red waters rather than swimming toward the blue ocean.

Red Ocean vs. Blue Ocean

"Blue Ocean Strategy," developed by W. Chan Kim and Renée Mauborgne, emphasises creating new market spaces—referred to as "blue oceans"—where competition is irrelevant.

Imagine a sea filled with fierce predators, all competing for the same limited food supply. The water turns red with blood as these predators fight each other. Now picture a vast, pristine blue ocean where creatures swim freely without conflict.

The key difference is that while red ocean strategies involve competing in known markets, blue ocean strategies aim to create entirely new market spaces where a company can thrive without direct competition.

South Africa’s Insurance Market

Naked Insurance stands out as one of the best-in-class InsurTechs in South Africa. They exemplify the broader trend in tech-enabled insurers contributing to the $4 trillion per annum global non-life insurance market.

South Africa’s non-life market is valued at ~$8.9 billion, with motor and property insurance accounting for roughly 25-30% each. While this is a highly competitive sector with around 70 registered insurers, it primarily serves a minority of the population.

Before diving deeper into Naked Insurance, let’s consider Pineapple (South Africa) and Lemonade (USA) for additional context.

Pineapple Insurance (South Africa)

Pineapple, arguably Naked’s closest competitor, ranks a step ahead in the red waters. I've also followed their journey since the beginning.

Pineapple’s products are underwritten by Old Mutual Insure, a well-established player in the South African market. The reinsurer is Hannover Re. Pineapple received early backing from Google (Launchpad Accelerator), and has since raised significant funding including a recent R400 million ($22 million) round led by Futuregrowth (Old Mutual) and other existing investors like Old Mutual ESD and Lireas Holdings (Hannover Re).

Lemonade Insurance (USA)

Lemonade’s products are underwritten by Lemonade Insurance Co, licensed in multiple US states, with reinsurance led by tier-one carriers. Lemonade received early backing from Aleph and Sequoia Capital and has since raised significant funding from various investors including a round led by SoftBank. Other investors include Allianz, General Catalyst, GV (formerly Google Ventures), OurCrowd, and Thrive Capital. Lemonade has expanded its operations to Germany, Netherlands, France, and the UK.

I’ve mentioned Lemonade before: “Its early years intrigued me as the vision seemed aligned with what we were building pre-2020. But their model and products fell short of what I envisioned, evolving into a traditional insurer with a sleek user interface (UI). Their social upliftment formula? Clever marketing, but not transformative. Listed July 2020 on the NYSE with a lacklustre performance that sadly reflects my observations.”—You can read my full post on Substack here or my X-thread here.

Naked Insurance (South Africa)

Quoting Moneyweb again: “The insurer plans to build a capital pool and expand its technological offering.”—These are both are very positive aspects—I’d guess that the majority (80-95%) will be allocated to the capital pool, which is always useful for an insurer.

“The latest round of financing comes from existing funders Hollard, Yellowwoods, International Finance Corporation [IFC], and Germany’s development finance institution [DEG]. A new funder BlueOrchard – an impact investor – has also now come on board.” This is my first issue: these are players with a mostly traditional approach to insurance.

My second—and bigger—issue is that Naked is underwritten by Hollard, the largest privately-owned insurance group in South Africa, which has been instrumental in supporting Naked’s growth and operational model since inception. Hollard’s consumer ratings make it clear that Naked provides a somewhat better front-end experience.

My third—and by far biggest—issue lies with the insurance products themselves: the epicentre of the Red Ocean.

Hellopeter (South Africa)

Hellopeter is a platform that connects South African consumers and businesses—a de facto ratings agency. Insurance is often rated as one of the least trusted industries globally, a reality that Hellopeter confirms in the context of South Africa.

In the non-life insurance category, Pineapple Insurance ranks 15th and their underwriter, Old Mutual Insure, 28th, while Naked Insurance ranks 27th and their underwriter, Hollard Insurance, 67th. Both Naked and Pineapple rank well ahead of their respective underwriters, showing just how poorly the traditional players are perceived by consumers.

Anecdotally, I asked a 30-something year-old male ‘techie’ where he was insuring his car, assuming it was still with Naked Insurance as I know he did in the past. He said all the legacy/mainstream brands were ridiculously expensive, Naked was better, but Pineapple was the best, so he went with them.

What Pineapple, Lemonade, and Naked Have in Common

Despite technological advances, they remain tied to the incumbent and traditional insurance model. That model continues to thrive financially for the incumbents but fails to serve the majority of the population effectively or equitably—for good reasons. Their red ocean is on full display—if you look through the right goggles.

Until players like Naked address the fundamental flaws in their products, they will remain stuck in the red waters of legacy insurance. Faster claims and better customer service are incremental improvements—but they don’t represent the kind of transformative change that defines blue oceans.

True innovation would mean rethinking the insurance product itself, creating models that cater to the underserved majority, are scalable across diverse markets, and break free from traditional constraints. Naked’s insistence on being digital-only is admirable, but it needs to be tempered with a more revolutionary vision for what insurance could and should be.

From Red to Blue Oceans

Naked Insurance, like its handful of peers, has made commendable strides in improving the customer experience in the non-life insurance sector. However, they remain tethered to a legacy model that limits their ability to create a truly transformative impact.

To swim in blue oceans, they—and others in the InsurTech space—must challenge the very foundations of insurance. Until then, they will remain successful predators in a crowded sea of red.